Oct 23, 2024

This article is cross-posted in partnership with Enigma

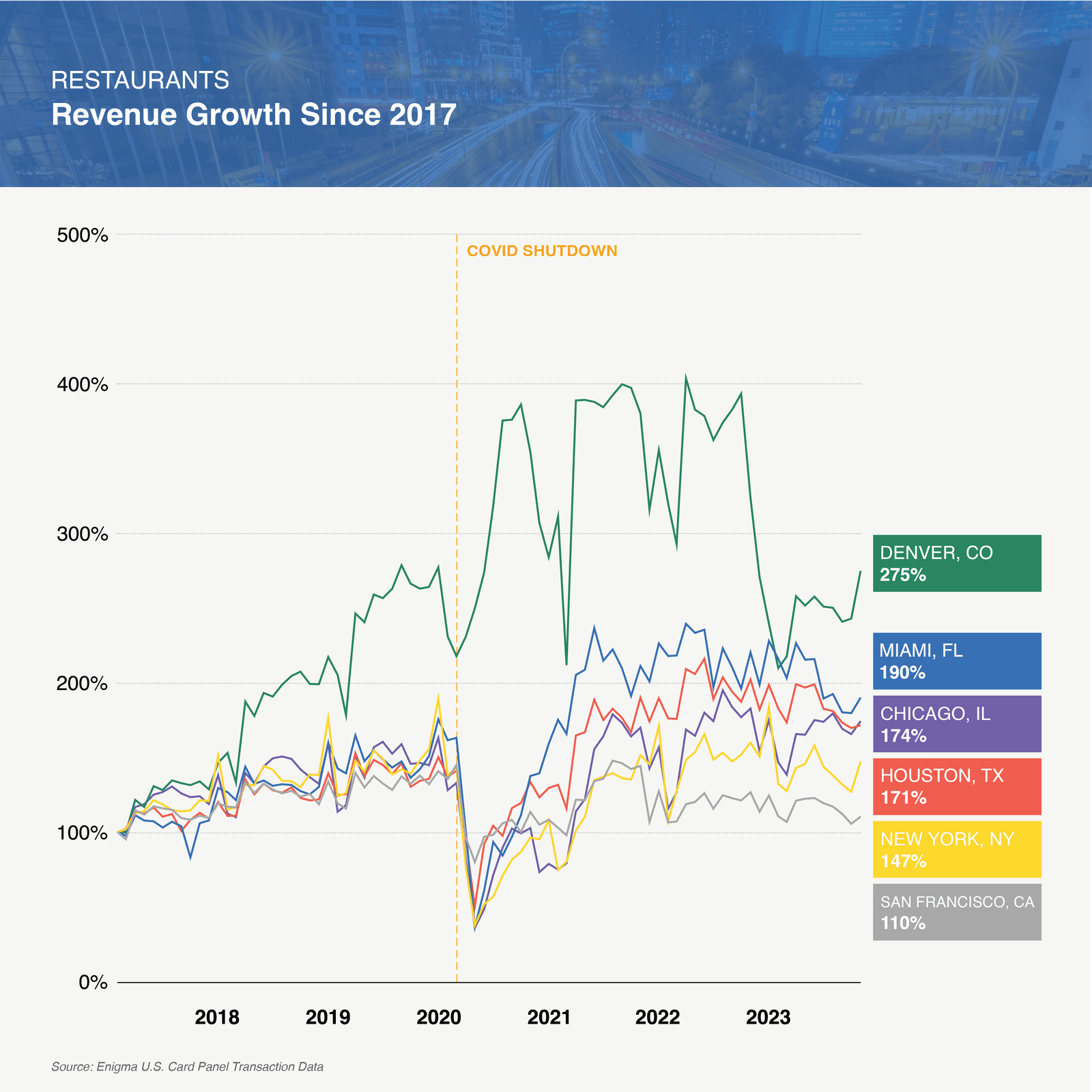

The restaurant industry took a major dip in revenue growth in 2020 amid Covid-19 shutdowns and – despite a rebound in 2021 – restaurants struggled to find their footing in 2023.

Using Enigma's card panel data of over 40% of transactions in the US – including a longtail of small and medium sized restaurants, we wanted to examine the state of the restaurant industry today. We look at everything from what drink trends are cool today to how different geographies continue to be affected by Covid-19 to market share of different sized restaurant chains.

Second Tier Cities Are Number One

Smaller US cities fared better than larger ones during Covid-19 and continue to grow at faster rates today.

Denver experienced a Covid-19 boom, outperforming 2017 restaurant revenues even in the height of Covid-19. In 2023, revenues for the city were up, but nowhere near mid-2020 and late-2022.

Denver was something of an outlier during this period - most other large or growing cities saw their restaurant revenues fall to ~40% of their January 2017 index during Covid, rebound over the next year to well above pre-Covid totals, flatten for 2 years, and decline slightly in 2023.

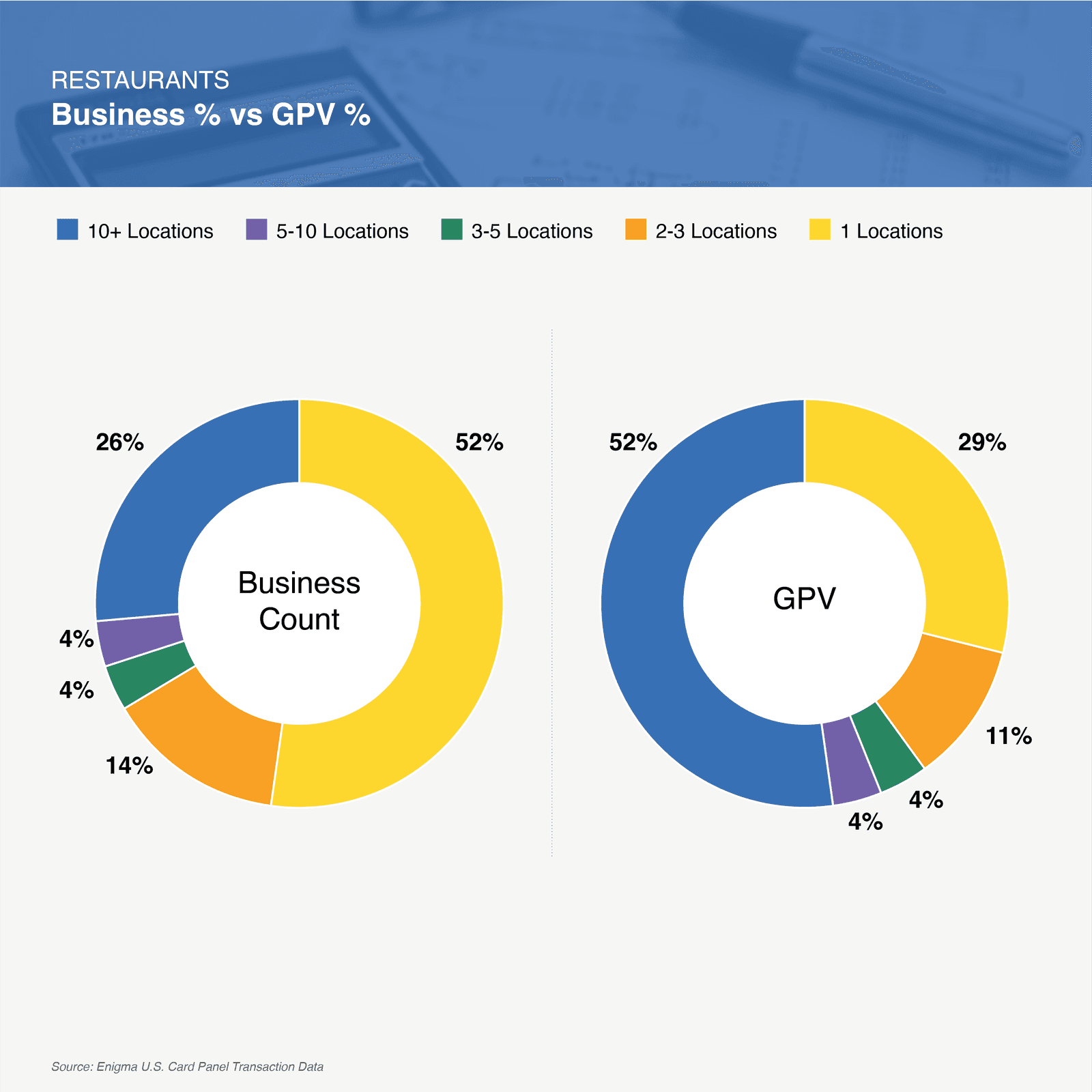

Chain Dominance

It’s a great time to own a chain restaurant – or to offer them services.

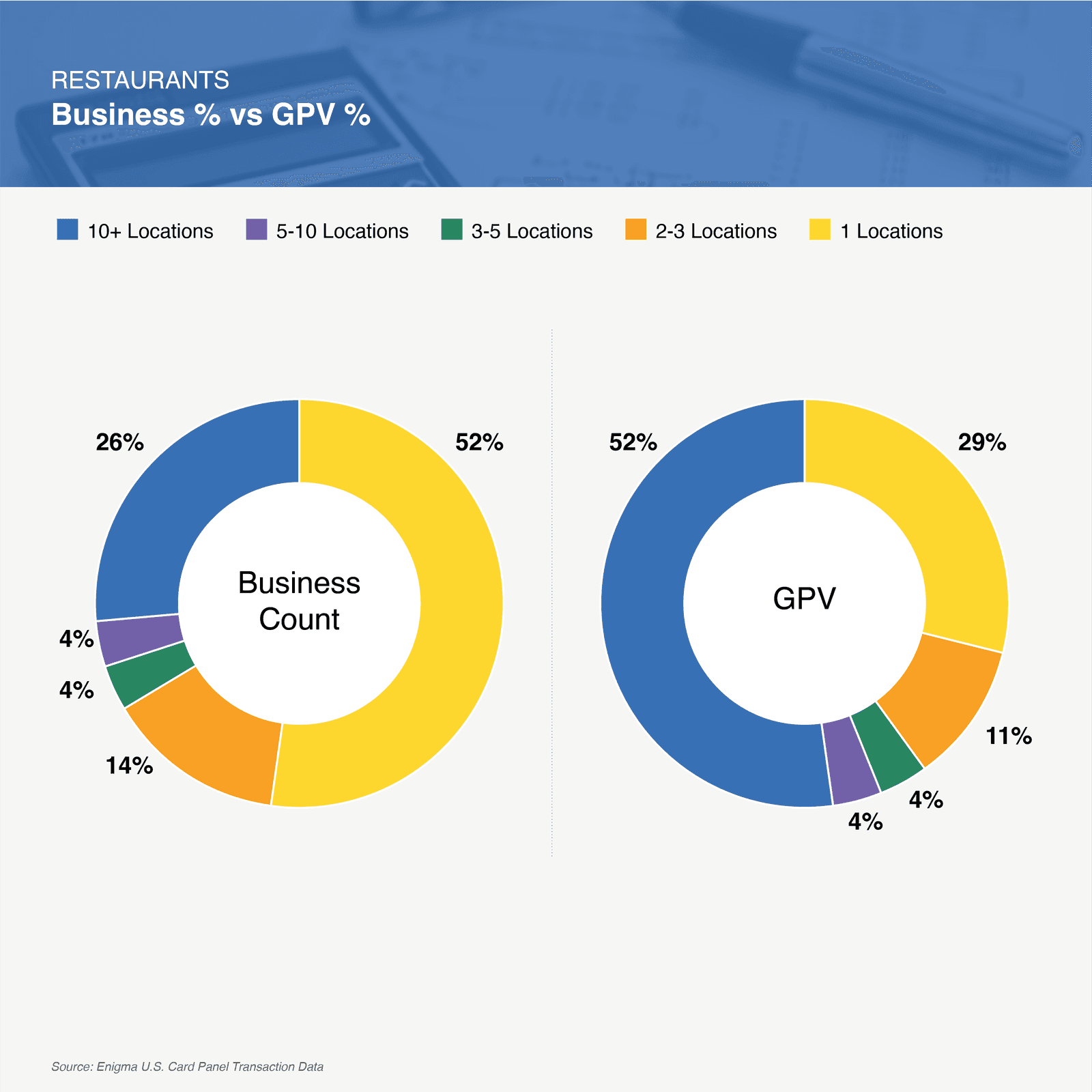

Less than half of restaurants in the US have multiple locations, however, these chains take up an outsized share of Gross Processing Volume (GPV), or the total value of transactions that pass through a payments system.

Businesses with 10+ locations account for 52% of total restaurant GPV in the U.S. while single location restaurants win only 29% of total restaurant GPV.

Fine Times for Fine Dining

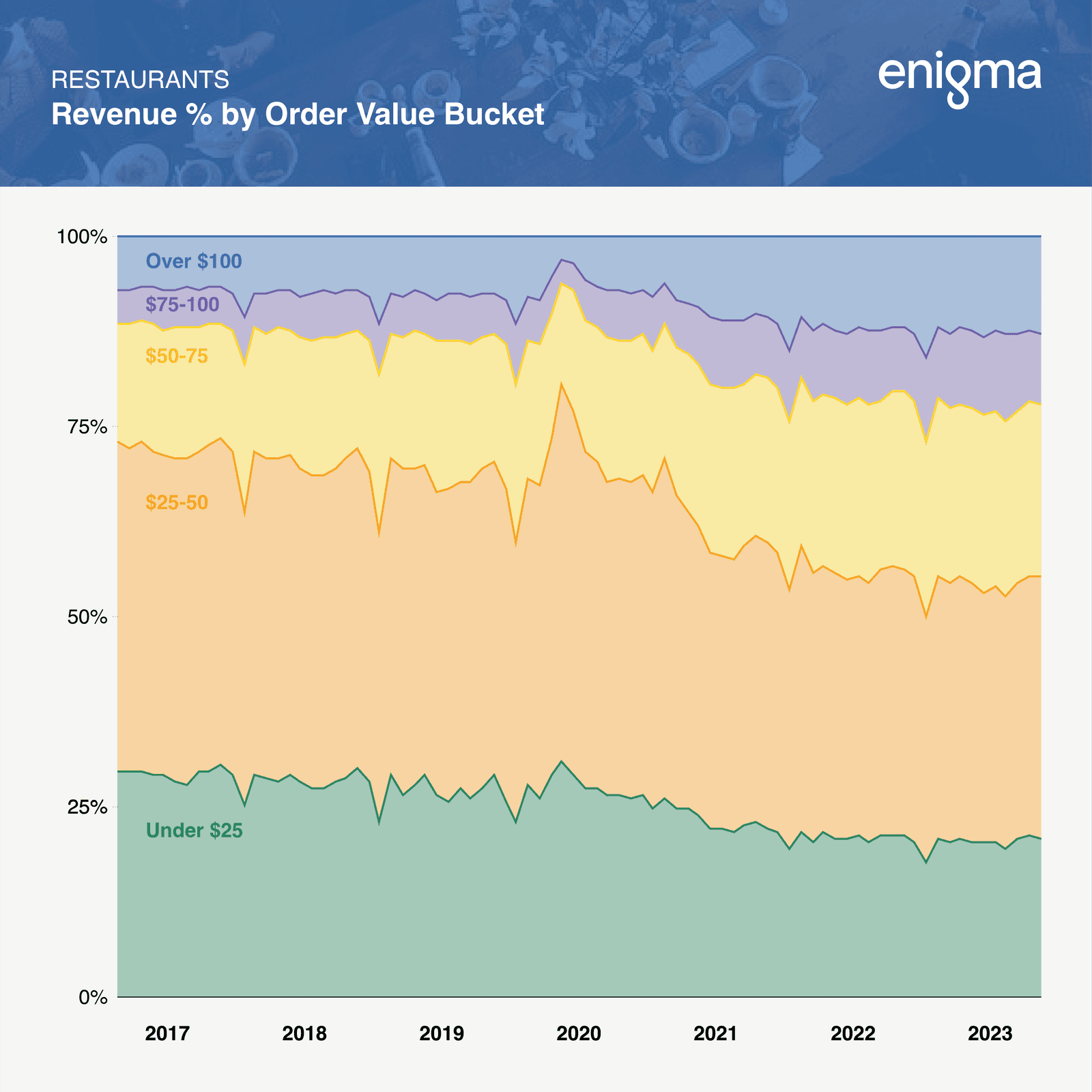

Fine dining is finding a foothold despite economic pressures.

While low-cost and mid-cost restaurants are struggling to grow beyond pre-pandemic highs, restaurants with an average ticket of $75-$100 and over $100, doubled their share of total restaurant revenue from 2017.

Bubble Tea Bubbles Up

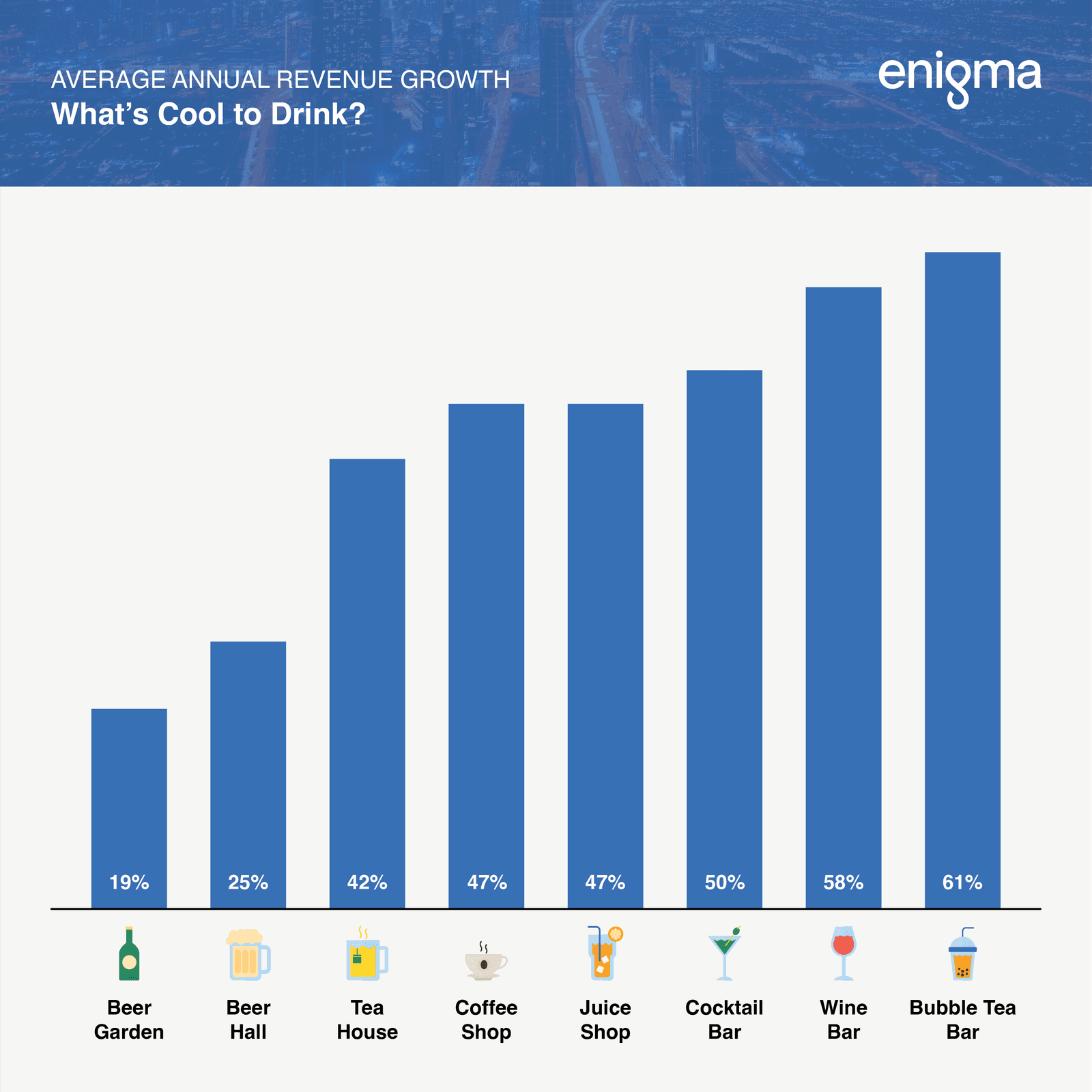

Bubble tea leads the drinks pack. Average annual revenue growth of bubble tea shops outpaces wine bars and juice shops.

Leading tea peers in revenue growth are i-Tea, Boba Love, Tea Top, Da Boba, and Tea Time.

The Infatuation Effect

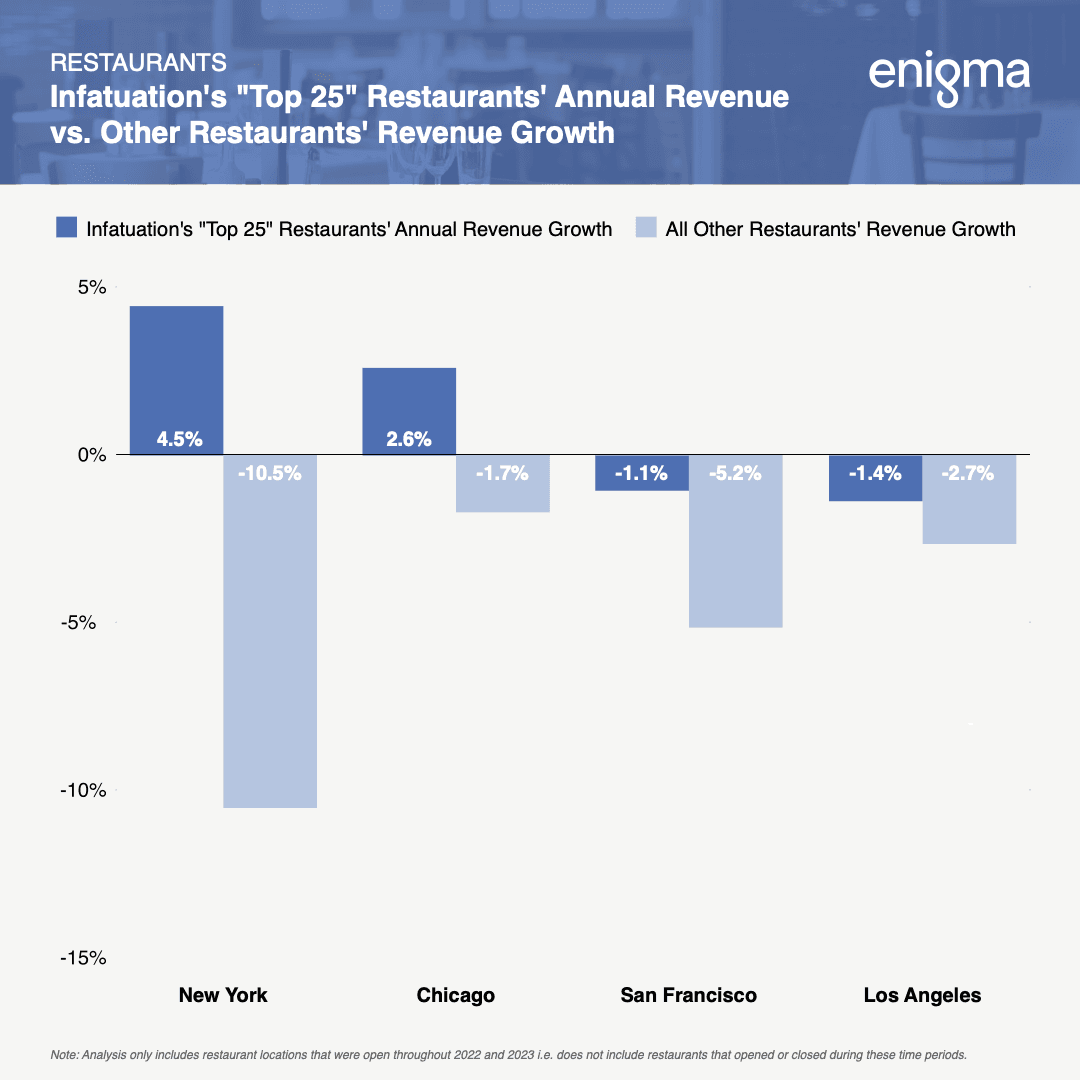

While restaurants in cities across the US experience middling or negative growth, restaurants featured in The Infatuation’s Top 25 Restaurants lists outpaced them. This also holds true across pricepoint: only high-end restaurants in San Francisco and Los Angeles beat out The Infatuation's Top 25.

This also holds true across pricepoint: only high-end restaurants in San Francisco and Los Angeles beat out The Infatuation's Top 25.

Better Target, Segment and Engage Restaurants

Enigma's data can help you learn more about the near-real-time revenues, locations, payment technologies and more of restaurants of any size across the US to help you better find and engage high-growth prospects.