Contact us

Your platform powers businesses

Your platform powers businesses

Your platform powers businesses

We power

their growth

We power

their growth

We power

their growth

Prime provides the turnkey capital, infrastructure, and embedded finance experience for users on your platform to unlock their next phase of growth.

Prime provides the turnkey capital, infrastructure, and embedded finance experience for users on your platform to unlock their next phase of growth.

Prime provides the turnkey capital, infrastructure, and embedded finance experience for users on your platform to unlock their next phase of growth.

Prime provides the turnkey capital, infrastructure, and embedded finance experience for users on your platform to unlock their next phase of growth.

Get started

Get started

Get started

Get started

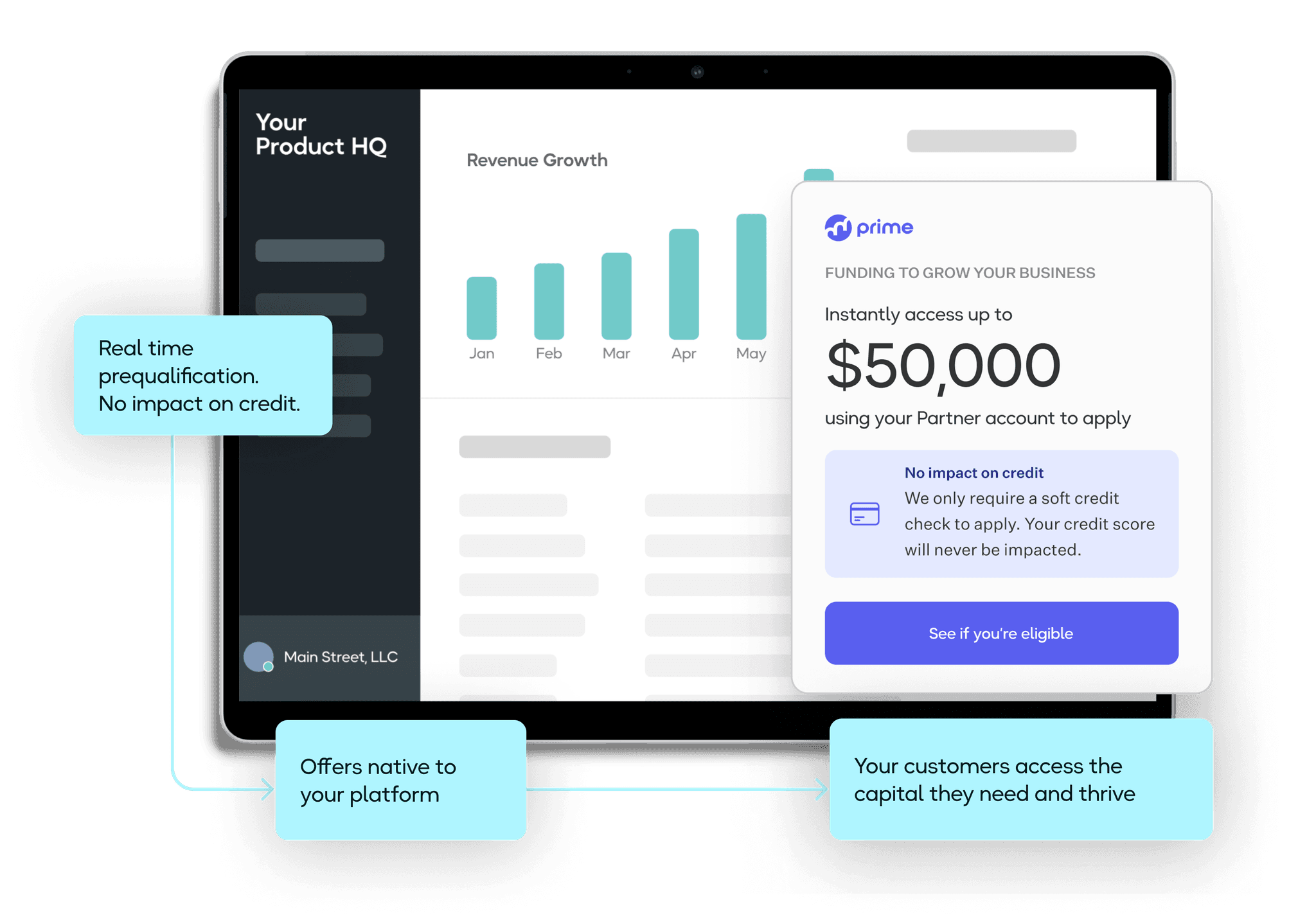

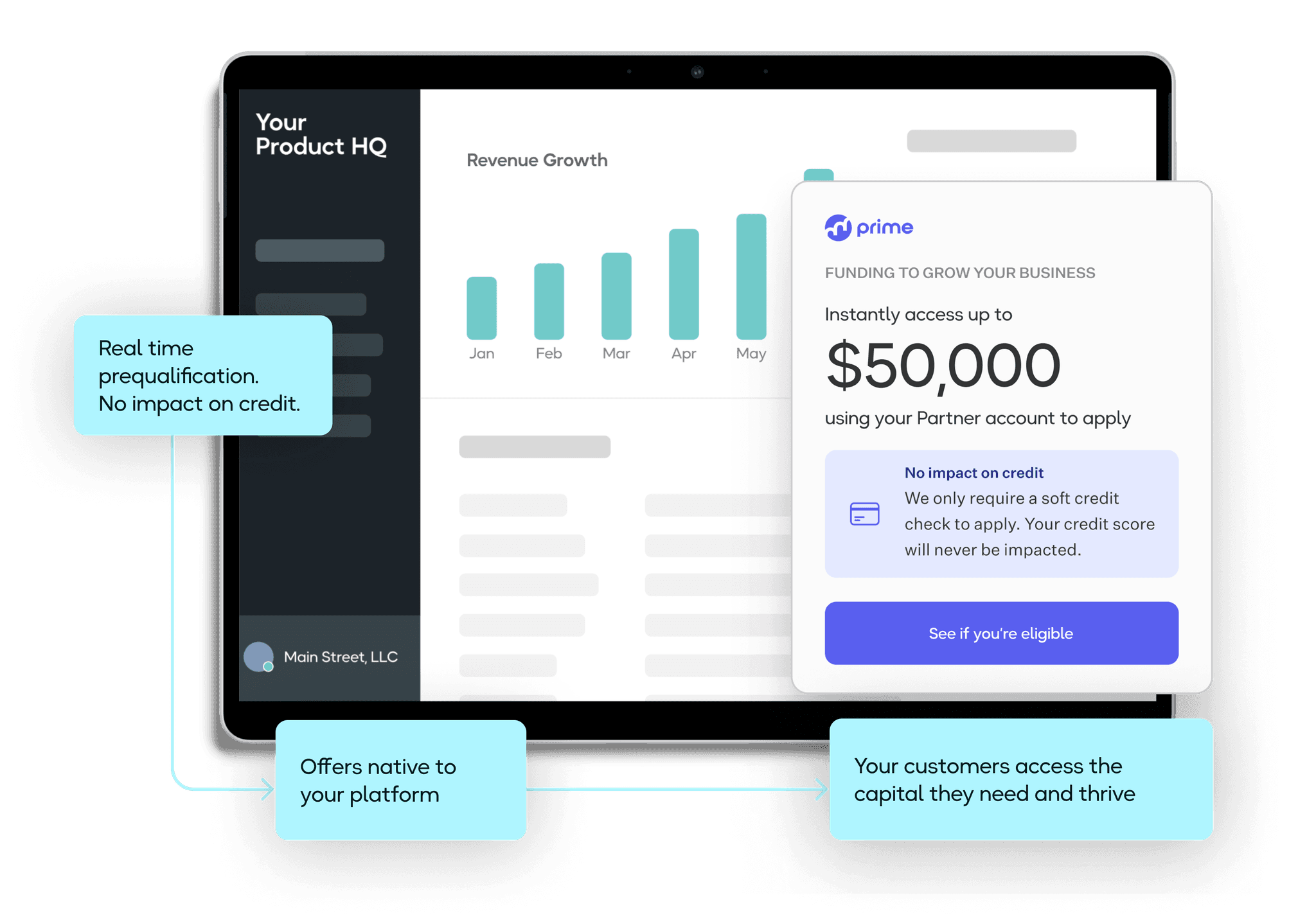

1

Get prequalified in real-time. No impact on credit.

2

Get offers native to your platform.

3

Your customers access the capital they need and thrive.

Powering financing for customers of

Embedded finance with Prime

unlocks new opportunities

Embedded finance with Prime

unlocks new opportunities

Increase revenue, sales, customer loyalty and the value of your platform

Increase revenue, sales, customer loyalty and the value of your platform

Learn more

Learn more

Learn more

Learn more

Revenue &

increased sales

Revenue &

increased sales

Revenue & increased sales

Revenue &

increased sales

Financing solutions enable our partners to earn revenue from every funded loan and boost sales by offering financing options.

Customer

loyalty

Customer loyalty

Customer

loyalty

Customer

loyalty

More than half of business owners don't get their financing needs met. By providing access to financing, you drive customer loyalty and retention.

Platform value

Platform value

Platform value

Platform value

Enhance your platform's value by offering comprehensive financing solutions. Enable customers to get the financing they need while harnessing the value of your first-party data.

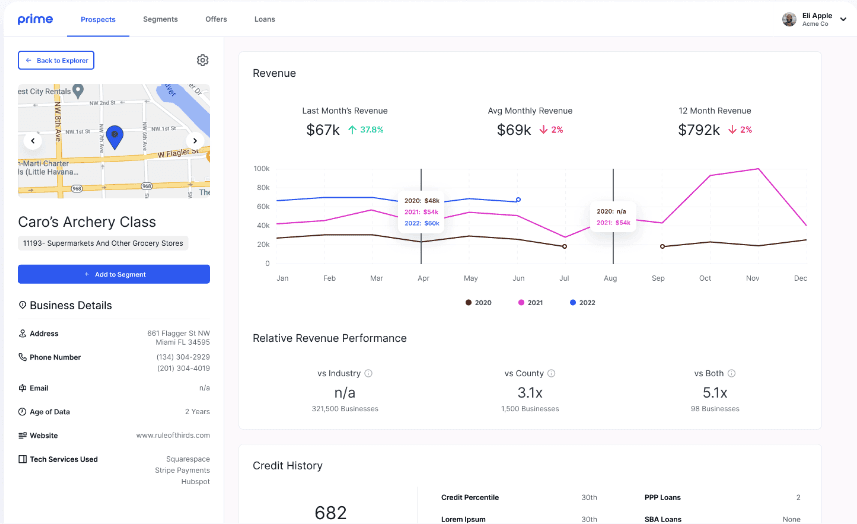

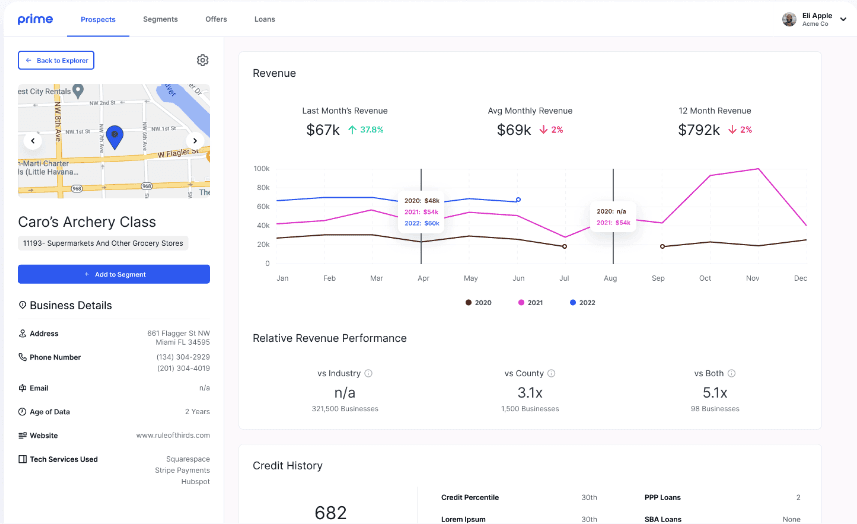

Prime’s data edge allows for a

full view of a business’ health

Traditional Financing

Traditional Financing

Documents required for analysis

2 years of tax returns

3 months of bank statements

P&L sheet

Company documents

Revenue

$100-500K

Age of Business

1-5 years

Industry

NAICS 722511

Loan Term

3 Months

Approved for

$5k

APR

36%

With Prime

Auto-analyzed

Revenue

$900K

Age of Business

2.5 years

Industry

Italian Restaurant

Growth

Top Quartile

Seasonality

Summer-Skewed

Summer-Skewed

Competitive

Advantage

Highly Differentiated

Prime’s Data

Loan Terms

12 Months

Approved for

$50k

APR

15%

No personal guarantee needed

Funds in 24 hours

No paperwork required

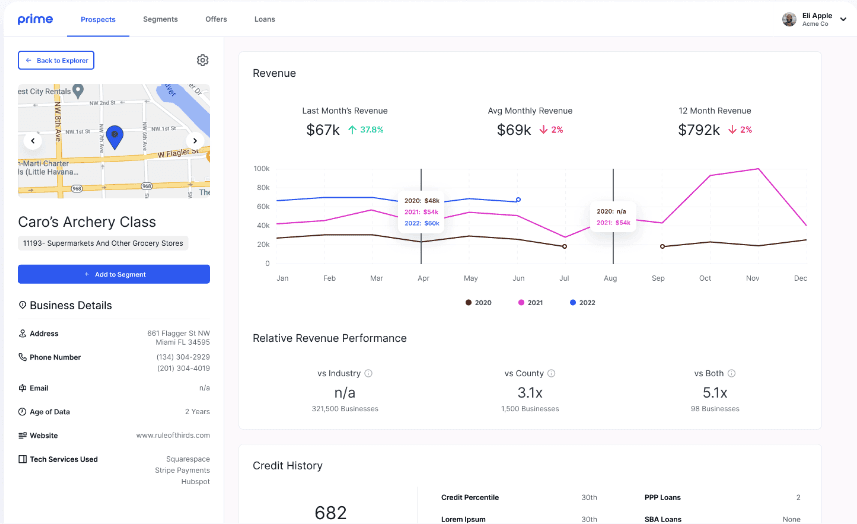

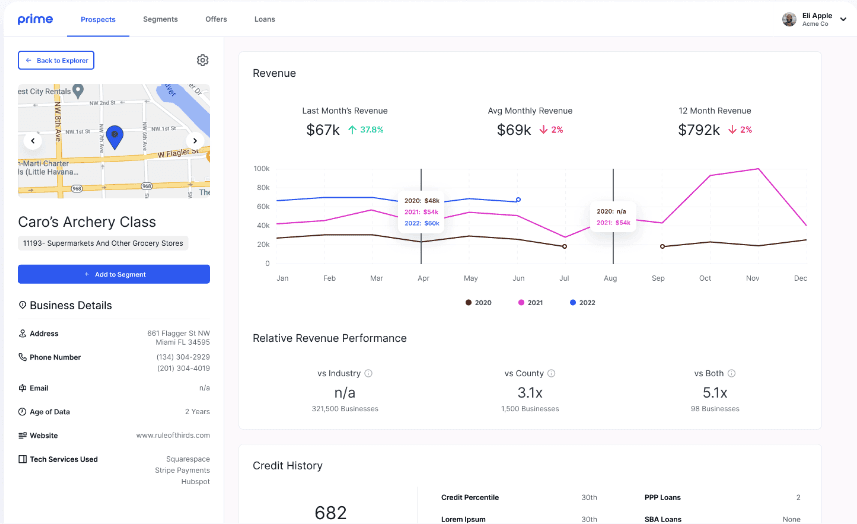

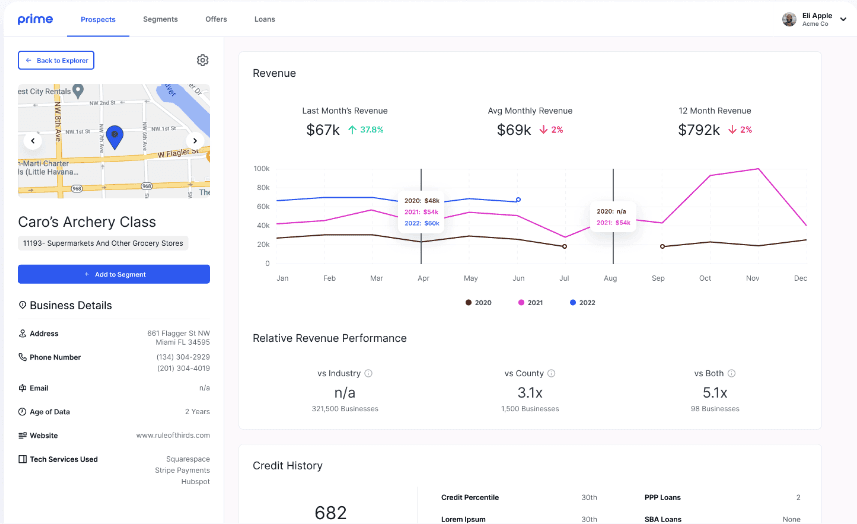

Business lifecycle

We understand the business lifecycle and meet your customers where they are. Our proprietary technology offers insights into their performance and what differentiates them from their peers.

Holistic view of the business

Prime has the ability to layer your platform’s unique data, our extensive 3rd party data sources and direct integration with an SMB’s financial systems in order to provide a comprehensive view of a business.

Verification

Fraud is a primary driver of losses in the small business lending space. Prime’s data usage allows both the verification of the overall business, as well as key attributes (ex: revenue) which are used in the underwriting process.

Traditional Financing

Documents required for analysis

2 years of tax returns

3 months of bank statements

P&L sheet

Company documents

Revenue

$100-500K

Age of Business

1-5 years

Industry

NAICS 722511

Loan Term

3 Months

Approved for

$5k

APR

36%

Loan Terms

12 Months

Approved for

$50k

APR

15%

No personal guarantee needed

Funds in 24 hours

No paperwork required

With Prime

Auto-analyzed

Revenue

$900K

Age of Business

2.5 years

Industry

Italian Restaurant

Growth

Top Quartile

Seasonality

Competitive

Advantage

Highly Differentiated

Prime’s Data

We hand-picked the best lending stack,

so you don’t have to

We hand-picked the best lending stack, so you don’t have to

We hand-picked the best lending stack,

so you don’t have to

We hand-picked the best lending stack,

so you don’t have to

Partnership Options

Prime offers a spectrum of options for launching an embedded finance program

Get in touch

Get in touch

Data exploration

Get a sense of the revenue opportunity. Understand the percentage of your population that Prime can pre-qualify. Begin to realize the value of your platform’s unique data.

Pre-qualification engine &

outbound marketing

We’ll pre-qualify your customers and proactively offer pre-qualified customers loans through your preferred marketing channel(s).

Prequalified Offer

Financing for your Purchase

Hey Main Street LLC, you’re pre-qualified for 6-12 months of financing to purchase a new espresso machine.

PRE-QUALIFIED

Financing Offer

No impact on Credit Score

6-12 Months Terms

Transparent Payments

Easy Application

Low-code embedded widget

Embed our low-code application into your platform. Whether you’d like to embed financing on your platform’s dashboard or at checkout, we have you covered. Use our pre-qualification engine to dynamically power the widget.

FUNDING TO GROW YOUR BUSINESS

Instantly access up to

$50,000

using your Partner account to apply

No impact on credit

We only require a soft credit check to apply. Your credit score will never be impacted.

See if you’re eligible

Custom API Integration

Use our APIs to build the embedded lending experience of your dreams. We handle funding, servicing and all the other complexities associated with a lending program.

Partner API

Request Financing Application

POST /ORIGINATE

Program

RC1-333601

Partner

Bill

Lender

Capital One

Product

AR Financing

+3 more

Backed by the best

32 Mercer St.

New York, NY 10013

32 Mercer St.

New York, NY 10013

Get in touch

Get in touch

Get in touch

Get in touch

Security you can trust, availability you can depend on. Prime has extensive security measures in place to protect you and your customer's data and ensure it's available. Prime utilizes best in class security measures and is SOC 2, Type 2 certified.

Security you can trust, availability you can depend on. Prime has extensive security measures in place to protect you and your customer's data and ensure it's available. Prime utilizes best in class security measures and is SOC 2, Type 2 certified.

Prime’s data edge allows for a full view of a business’ health

Business lifecycle

We understand the business lifecycle and meet your customers where they are. Our proprietary technology offers insights into their performance and what differentiates them from their peers.

Holistic view of the business

Prime has the ability to layer your platform’s unique data, our extensive 3rd party data sources and direct integration with an SMB’s financial systems in order to provide a comprehensive view of a business.

Verification

Fraud is a primary driver of losses in the small business lending space. Prime’s data usage allows both the verification of the overall business, as well as key attributes (ex: revenue) which are used in the underwriting process.

Traditional Financing

Documents required for analysis

2 years of tax returns

3 months of bank statements

P&L sheet

Company documents

Revenue

$100-500K

Age of Business

1-5 years

Industry

NAICS 722511

Loan Term

3 Months

Approved for

$5k

APR

36%

Loan Terms

12 Months

Approved for

$50k

APR

15%

No personal guarantee needed

Funds in 24 hours

No paperwork required

With Prime

Auto-analyzed

Revenue

$900K

Age of Business

2.5 years

Industry

Italian Restaurant

Growth

Top Quartile

Seasonality

Summer-Skewed

Competitive

Advantage

Highly Differentiated

Prime’s Data

Partnership Options

Prime offers a spectrum of options for launching an embedded finance program

Get in touch

Get in touch

Data exploration

Get a sense of the revenue opportunity. Understand the percentage of your population that Prime can pre-qualify. Begin to realize the value of your platform’s unique data.

Pre-qualification engine &

outbound marketing

We’ll pre-qualify your customers and proactively offer pre-qualified customers loans through your preferred marketing channel(s).

Prequalified Offer

Financing for your Purchase

Hey Main Street LLC, you’re pre-qualified for 6-12 months of financing to purchase a new espresso machine.

PRE-QUALIFIED

Financing Offer

No impact on Credit Score

6-12 Months Terms

Transparent Payments

Easy Application

Low-code embedded widget

Embed our low-code application into your platform. Whether you’d like to embed financing on your platform’s dashboard or at checkout, we have you covered. Use our pre-qualification engine to dynamically power the widget.

FUNDING TO GROW YOUR BUSINESS

Instantly access up to

$50,000

using your Partner account to apply

No impact on credit

We only require a soft credit check to apply. Your credit score will never be impacted.

See if you’re eligible

Custom API Integration

Use our APIs to build the embedded lending experience of your dreams. We handle funding, servicing and all the other complexities associated with a lending program.

Partner API

Request Financing Application

POST /ORIGINATE

Program

RC1-333601

Partner

Bill

Lender

Capital One

Product

AR Financing

+3 more

Partnership Options

Prime offers a spectrum of options for launching an embedded finance program

Get in touch

Get in touch

Data exploration

Get a sense of the revenue opportunity. Understand the percentage of your population that Prime can pre-qualify. Begin to realize the value of your platform’s unique data.

Pre-qualification engine &

outbound marketing

We’ll pre-qualify your customers and proactively offer pre-qualified customers loans through your preferred marketing channel(s).

Prequalified Offer

Financing for your Purchase

Hey Main Street LLC, you’re pre-qualified for 6-12 months of financing to purchase a new espresso machine.

PRE-QUALIFIED

Financing Offer

No impact on Credit Score

6-12 Months Terms

Transparent Payments

Easy Application

Low-code embedded widget

Embed our low-code application into your platform. Whether you’d like to embed financing on your platform’s dashboard or at checkout, we have you covered. Use our pre-qualification engine to dynamically power the widget.

FUNDING TO GROW YOUR BUSINESS

Instantly access up to

$50,000

using your Partner account to apply

No impact on credit

We only require a soft credit check to apply. Your credit score will never be impacted.

See if you’re eligible

Custom API Integration

Use our APIs to build the embedded lending experience of your dreams. We handle funding, servicing and all the other complexities associated with a lending program.

Partner API

Request Financing Application

POST /ORIGINATE

Program

RC1-333601

Partner

Bill

Lender

Capital One

Product

AR Financing

+3 more